Represents the top 20 of Malaysians. Headquarters of Inland Revenue Board Of Malaysia.

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

For instance transportation costs was recorded to have increased by 117 between FY2016 and FY2017.

. Tax RM 0 2500. Malaysias Individual Income Tax Rate is 15. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

Here are the progressive income tax rates for Year of Assessment 2021. Chargeable Income Calculations RM Rate TaxRM 0 - 5000. A non-citizen receiving a monthly salary of not less than RM25000 and holding key positions C-Suite positions is taxed at a flat rate of 15 for a period of 5 consecutive years.

On the First 20000 Next 15000. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. Taxable income band MYR.

On the First 20000 Next 15000. Additionally taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in Malaysia. As an example lets say your annual taxable income is RM48000.

On the First 5000 Next 15000. In 2016 and 2019 average income recipients in Malaysia was 18 persons. On the First 50000 Next 20000.

Personal Tax 2021 Calculation. All persons staying in Malaysia for more than 182 days no matter where you are from are considered residents under Malaysian tax law. Ad Compare Your 2022 Tax Bracket vs.

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Sales tax fully waived for new passenger vehicles. Based on this amount the income tax to pay the government is RM1640 at a rate of 8.

Chargeable income RM20000. There are no other local state or provincial government taxes. Is the middle income number within a range of.

Taxable income band MYR. Household Income and Basic Survey Amenities Report 2019 DOSM. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. Represents 40 of Malaysians. Total tax amount RM150.

On subsequent chargeable income. Taxable income band MYR. In Malaysia costs of living are progressively increasing year-on-year such as food prices transportations household etc.

On the First 2500. 100 exemption on import and excise duties sales tax and road tax for electric vehicles. Total tax reliefs RM16000.

Up to RM3000 for kindergarten and daycare fees. Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to. Overall income that is earned by household members whether in cash or kind and can be referred to as gross income. Tax rates on chargeable income of resident individual taxpayers are calculated on a graduated scale with the lowest rate being 0 percent on the first RM5000 of chargeable income and the highest rate reaching 30 percent on chargeable income surpassing RM2000000 taking effect from the year 2020.

Calculations RM Rate TaxRM 0 - 5000. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. No other taxes are imposed on income from petroleum operations.

Paid-up capital of more than RM25 million. Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

On the First 35000 Next 15000. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. On the First 50000 Next 20000.

Discover Helpful Information And Resources On Taxes From AARP. Malaysia Residents Income Tax Tables in 2022. Income Tax Rates and Thresholds Annual.

It should be noted that this takes into account all. Taxable income band MYR. More than RM10970 and above.

Personal income tax at the highest rate is still only 27. In 2019 the average monthly income in Malaysia is RM7901. On the First 2500.

13 rows Personal income tax rates. Your 2021 Tax Bracket To See Whats Been Adjusted. Introduction Individual Income Tax.

On the First 70000 Next 30000. On the First 5000 Next 15000. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 for 5 consecutive YAs.

On the First 35000 Next 15000. On the first RM 600000 chargeable income. Malaysia Residents Income Tax Tables in 2020.

Taxable income band MYR. The following rates are applicable to. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN.

On the First 2500. Annual income RM36000. In other words think of income tax as just another form of expenditure which has to be paid by every individual.

RM9000 for individuals. Ali work under real estate company with RM3000 monthly salary. Taxable income band MYR.

Income Tax Rates and Thresholds Annual.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysian Tax Issues For Expats Activpayroll

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

How To Calculate Foreigner S Income Tax In China China Admissions

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

7 Tips To File Malaysian Income Tax For Beginners

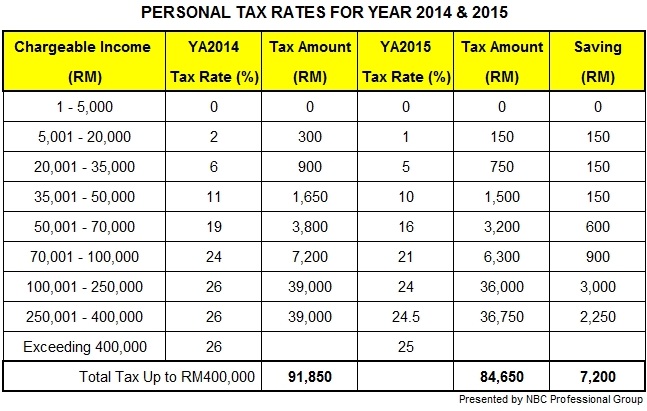

Budget 2015 New Personal Tax Rates For Individuals Ya2015 Tax Updates Budget Business News

Tax Guide For Expats In Malaysia Expatgo

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysia Budget 2021 Personal Income Tax Goodies

Personal Tax Archives Tax Updates Budget Business News

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done Stocknews

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Individual Income Tax In Malaysia For Expatriates

10 Things To Know For Filing Income Tax In 2019 Mypf My

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News